Aging assets, an evolving regulatory landscape, environmental challenges, and the energy transition are causing natural gas companies to transform the way they invest in their businesses.

Our main goal was to integrate multiple risk models into one system to support our regulatory reporting. Copperleaf has helped us achieve that goal and has also allowed us to produce an effective investment strategy for our GD2 price control period.

Naveen Panwar

Senior Data Analyst

SGN

ONE Gas has over 3 million assets loaded in Copperleaf’s solution. Across the enterprise, ONE Gas can look holistically at these assets, scope projects, and optimize a work plan that delivers the most value to our stakeholders.

Matt Fulghum

Director, Asset Investment Planning and Management

ONE Gas

The biggest benefit is that we now have an end-to-end solution. We can start off with a rough idea of the projects we need to undertake to achieve our strategy and then track that investment all the way through to delivery and benefits realization.

Neil Tansley

Asset Modeling Manager

National Grid Gas Transmission

Copperleaf provides us with a framework and the technology to enable us to make the best decisions for our customers and our stakeholders.

Paul Chernikhowsky

Director of Engineering

FortisBC

Now that we have the Copperleaf solution, we have synergies between our data and our departments. The work is driven by the software and this has brought about a fundamental change in the way we operate.

Jowita Uler

Portfolio Planning Manager

National Grid Gas Transmission

Implementation of enterprise-wide technology has enabled us to evaluate assets and projects using a consistent risk management framework—a game changer for the way we plan for work and capital expenditures.

ONE Gas Annual Report

Normalizing all investments in one platform simplifies conversations. When we’re talking with regulators, it’s easier for us to explain that if we don’t make a certain investment, here are the likely long-term consequences. We can make a stronger case, and it’s all backed up with data.

Pradheep Kileti

Director, Future of Heat and R&D Program Management

National Grid

You’ve got to plan around not just the portfolio of one type of work, but the portfolio of all the work taking place in the utility. When you’re dealing with a large portfolio, you need asset investment planning tools that Copperleaf brings to the table.

Andy Abranches

Senior Director, Wildfire Risk Management

Pacific Gas & Electric (PG&E)

Decision Analytics for Natural Gas Utilities

Aging infrastructure, decarbonization goals, new technologies, and Environmental, Social, and Governance (ESG) commitments are changing the way natural gas utilities allocate money and resources. Increased investment is required to maintain and upgrade assets to meet performance levels, satisfy regulatory demands, and build resilience in the face of climate change—while continuing to deliver safe, reliable, and affordable energy to customers. To thrive in this environment, utilities must strike the right balance between cost-effectively managing business-as-usual activities and investing for the future.

How can you be confident you’re making the best decisions that deliver the greatest value and drive your strategic goals?

Copperleaf® has been working at the forefront of asset management best practices for more than 20 years, delivering best-in-class decision analytics solutions to many of the world’s leading utilities. By developing frameworks to evaluate all investment options on equal footing, we make it easy for clients to compare dissimilar projects—from those designed to meet KPIs related to operational safety, system reliability, and customer satisfaction, to investments in growth or emerging technologies—and create plans that are transparent, defensible, and aligned with strategic objectives. The Copperleaf Decision Analytics Solution can help your organization identify the optimal investment strategy and dynamically adapt plans in the face of unprecedented change and uncertainty.

Proactively Manage Risk Exposure

Explore how different levels of investment impact risk to build a robust, defensible plan.

Improve Planning Efficiency

Assess all investments consistently in a centralized system to break down silos and expedite approvals.

Allocate Funding and Resources with Confidence

Develop executable plans that maximize capital efficiency—while meeting targets and constraints.

Execute Corporate Strategy

Align investments with your strategic goals, including financial, net-zero, ESG, reliability, and other targets.

Proven Solution Delivers High ROI

Every Copperleaf client has achieved 100% return on their investment within their first planning cycle—and every organization that has implemented our solution continues to use it successfully today. Measurable results include:

increase in capital efficiency

reduction in risk exposure

reduction in planning time

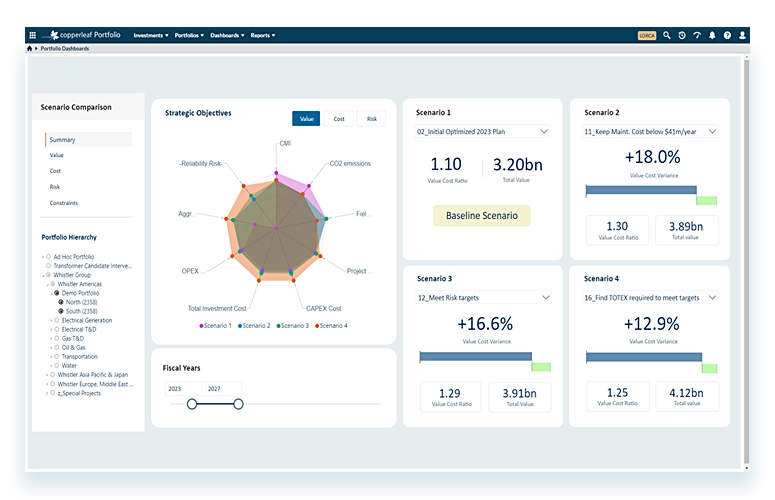

Create optimal investment plans to drive your strategic goals

Delivering the highest value means doing the right projects at the right time. This is no easy task for organizations that deal with hundreds of potential investment options, with multiple alternatives and start dates to consider.

Copperleaf’s AI-powered optimization can evaluate the vast number of possibilities and identify the optimal plan within minutes. Sensitivity analysis can easily be performed to explore the impact of different funding, timing, and resource constraints on value and risk, and build a realistic, deliverable plan to achieve your strategic goals.

Capital planning for climate resilience

The impacts of climate change are growing and utilities are under pressure to demonstrate that they are making the right investments at the right time. This playbook explores three ways asset investment planning software can support highly effective capital planning to achieve utility climate resilience.

Plan with agility in a dynamic environment

As your business environment changes, new tactical and strategic priorities emerge. Copperleaf makes it easy to quickly run what-if analyses to explore various investment strategies, build consensus, and align investment decisions with new strategic priorities.

Copperleaf enables a continuous planning process by highlighting variances between planned and actual performance. No matter what twists and turns arise during execution, you’ll be able to re-optimize plans, communicate and defend any changes to stakeholders, and adapt quickly to maintain optimal business performance.

Decision analytics for net zero & ESG

As ESG and net zero continue to rise in importance, utilities are leveraging decision analytics to achieve these goals efficiently and cost effectively. This Utility Week report explains how the Copperleaf Value Framework can be developed and deployed to underpin better decisions on where to invest. Download this report to explore how decision analytics can help you achieve your ESG and net-zero goals.

Drive your ESG strategy

Copperleaf helps organizations turn aspirational ESG objectives into action by offering a practical way to incorporate ESG metrics into everyday decision making. By expanding your assessment of project value to include impacts on ESG, you’ll be able to:

- Understand how each investment contributes to ESG performance

- Build plans that meet short- and long-term commitments

- Make trade-off decisions that balance business-as-usual and ESG goals

Adopted by Industry Leaders

Using automation to group linear assets at Northern Gas Networks

A common problem for organizations managing large networks of linear assets is ensuring that all urgent and future work required in a specific area is being considered. Doing so helps minimize service outages and reduce costs by ensuring the work makes efficient use of time, labor, and equipment. In this article, Ian Coates, Asset Strategy Lead at Northern Gas Networks describes the benefits of Rules-based Grouping—a capability within Copperleaf Asset™ that allows users to apply configurable rules to automate the process of bundling project work.

Integrated AIPM process at National Grid Gas Transmission

Many organizations still rely on a modeled view of asset risk and intervention strategies, which can lead to a disconnect between the plan and the projects that are actually delivered. Copperleaf helped National Grid Gas Transmission (NGGT) integrate bottom-up asset strategies with top-down project portfolios and align with ISO 55000 best practices. The Copperleaf solution will help NGGT deliver its business plan as cost-effectively as possible, contributing to a 4% efficiency on capital expenditure, saving £11 million per year.

Multi-sector asset investment planning at RNG

Rheinische NETZGesellschaft mbH (RNG) manages over 30,000 km of distribution networks for electricity, gas, water, and district heating in Germany. The Copperleaf Decision Analytics Solution is helping RNG manage risks and project portfolios across multiple networks and asset owners, and align its Asset Investment Planning and Management (AIPM) processes with the ISO 55000 asset management standard.

Our Product Suite

Copperleaf provides a highly-configurable enterprise software solution that can grow with you as your business needs evolve. It integrates seamlessly with existing EAM, APM, ERP, GIS, and other systems for more efficient, data-driven decision making.

Explore our resources

Blog

PIPES 2021: Copperleaf Connects Pipeline Clients from Around the World

News

Gas Industry Awards 2021: Copperleaf Wins in Two Categories

Blog

Monetised Risk in the Energy Sector

Discover our client success stories

Case Study

ONE Gas Develops Risk-Informed Asset Investment Planning

Case Study

Case Study: An Integrated Asset Investment Planning and Management Process at National Gas Transmission

Blog