Volatile margins, aging assets, decarbonization, sustainability commitments, and digitalization are causing oil and gas companies to transform the way they allocate capital.

Our project evaluations are more consistent and comprehensive, and the Copperleaf Value Framework provides us with a reliable means to understand trade-offs between investments of all types.

Lucas Rubinacci

Head of Strategic Planning Downstream

YPF

The oil and gas industry perpetually seems rife with uncertainty and a potential volatility. Between rising and diminishing consumer demand, price fluctuations, and [geopolitical issues], every day holds surprises and risks.

KPMG

DRILLING DOWN Oil & Gas Magazine

This is a moment for oil and gas companies to make thoughtful choices: both to improve their economic and reputational resilience, and to consider whether and how to reposition themselves to take advantage of the accelerating low-carbon winds of change.

McKinsey & Company

The big choices for oil and gas in navigating the energy transition

Decision Analytics for Oil & Gas

Mounting pressures from investors, customers, communities, and other stakeholders are creating huge capital planning challenges for oil and gas companies globally. Organizations are being held accountable to deliver on their financial, safety, and reliability targets—while investing in new initiatives to embrace digitalization, explore growth opportunities, increase operational efficiency, and meet Environmental, Social, and Governance (ESG) commitments. To successfully navigate this challenging business environment, companies must find—and fund—the right balance of investments to demonstrate progress toward these goals and deliver meaningful results.

How can you be confident you’re making the best decisions that deliver the greatest value and drive your strategic goals?

Copperleaf® is helping organizations manage billions of dollars of oil and gas and petrochemical assets across the globe. By developing frameworks to evaluate all investment options on equal footing, we make it easy for clients to compare dissimilar projects—from those designed to increase safety and reliability, to initiatives that reduce fugitive emissions or build climate resilience—and create plans that are transparent, defensible, and aligned with strategic objectives. The Copperleaf Decision Analytics Solution can help your organization decide where and when to invest in your business to proactively manage CapEx and OpEx, meet performance targets, maximize capital efficiency, and achieve your ESG and financial goals.

Proactively Manage Risk Exposure

Explore how different levels of investment impact risk to build a robust, defensible plan.

Improve Planning Efficiency

Assess all investments consistently in a centralized system to break down silos and expedite approvals.

Allocate Funding and Resources with Confidence

Develop executable plans that maximize capital efficiency—while meeting targets and constraints.

Execute Corporate Strategy

Align investments with your strategic goals, including financial, net-zero, ESG, reliability, and other targets.

Proven Solution Delivers High ROI

Every Copperleaf client has achieved 100% return on their investment within their first planning cycle—and every organization that has implemented our solution continues to use it successfully today. Measurable results include:

increase in capital efficiency

reduction in risk exposure

reduction in planning time

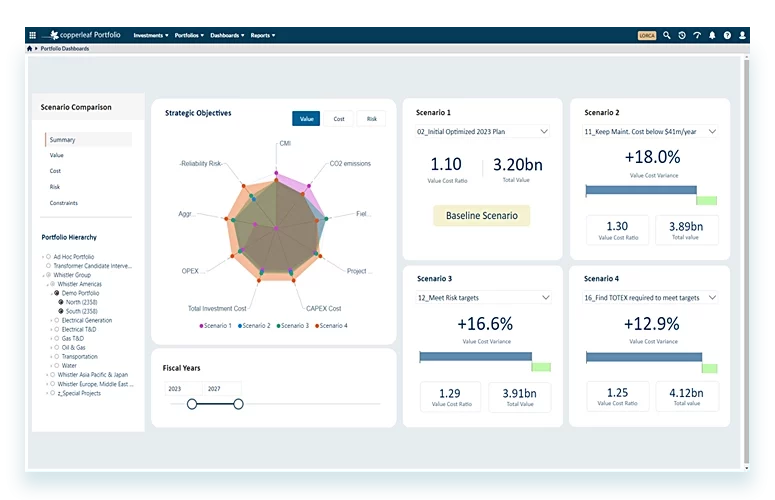

Create optimal investment plans to drive your strategic goals

Delivering the highest value means doing the right projects at the right time. This is no easy task for organizations that deal with hundreds of potential investment options, with multiple alternatives and start dates to consider.

Copperleaf’s AI-powered optimization can evaluate the vast number of possibilities and identify the optimal plan within minutes. Sensitivity analysis can easily be performed to explore the impact of different funding, timing, and resource constraints on value and risk, and build a realistic, deliverable plan to achieve your strategic goals.

Proactively manage risk across diverse assets

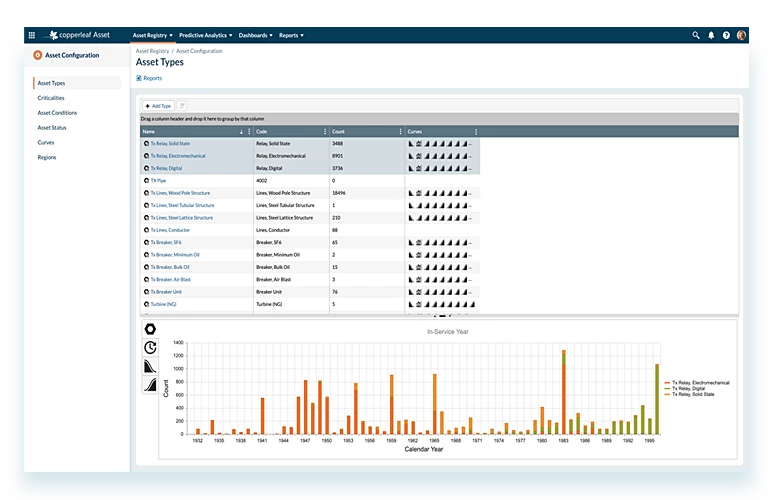

Many oil and gas companies struggle to forecast sustainment needs across the diverse asset types that exist within their upstream, midstream, and downstream businesses. Copperleaf can help your organization optimize asset performance by calculating the risk, cost, and value over time across all asset types and determining optimal intervention dates. This enables asset managers to create the best sustainment strategy while accounting for all business constraints.

Plan with agility in a dynamic environment

As the business environment changes, new tactical and strategic priorities emerge. Copperleaf makes it easy to quickly run what-if analyses to explore various investment strategies, build consensus, and align investment decisions with new strategic priorities.

Copperleaf enables a continuous planning process by highlighting variances between planned and actual performance. No matter what twists and turns arise during execution, you’ll be able to re-optimize plans, communicate and defend any changes to stakeholders, and adapt quickly to maintain optimal business performance.

Drive your ESG strategy

Copperleaf helps organizations turn aspirational ESG objectives into action by offering a practical way to incorporate ESG metrics into everyday decision making. By expanding your assessment of project value to include impacts on ESG, you’ll be able to:

- Understand how each investment contributes to ESG performance

- Build plans that meet short- and long-term commitments

- Make trade-off decisions that balance business-as-usual and ESG goals

Adopted by Industry Leaders

Best practices for capital planning excellence

A multinational midstream company implemented the Copperleaf Decision Analytics Solution as part of an enterprise-wide asset management transformation. Capital planning excellence has enabled the organization to streamline operations and transform its decision-making processes to realize 15% more value from its investment portfolios and secure a 30% increase in maintenance capital spend.

Optimizing CapEx investment at YPF

YPF, the leading vertically-integrated oil and gas company in Argentina, selected the Copperleaf Decision Analytics Solution for its downstream business. The system went live in 2018 to help YPF optimize its CAPEX investment portfolios, proactively manage risk, and align investment planning processes with the ISO 55000 standard.

Improving AIPM at Idemitsu Kosan

Idemitsu Kosan is one of Japan’s leading producers and suppliers of energy. The company selected the Copperleaf Decision Analytics Solution to help the company establish a more transparent and consistent Asset Investment Planning and Management (AIPM) process. The implementation of the Copperleaf solution aims to streamline the capital planning process by providing a centralized platform to plan, approve, and manage investments.

Our Product Suite

Copperleaf’s scalable enterprise software solution can grow with you as your business needs evolve. It integrates seamlessly with existing EAM, APM, ERP, GIS, and other systems for more efficient, data-driven decision-making.

Explore our resources

White Paper

Delivering Value in the Oil & Gas Sector

Brochure

Maximize Capital Efficiency in Oil and Gas

Blog