Webinar Recap: Equitable Investment Strategies for a Just Energy Transition

Environmental justice refers to the equal right to protection from environmental and health hazards. It’s an increasingly important consideration for any organization making asset investment planning decisions, because so much critical infrastructure is built within, through, and for the communities we live in.

I recently had the opportunity to participate in a webinar hosted by the Centre for Energy Advancement through Technological Innovation (CEATI) where we discussed a few investment strategies to consider when it comes to doing our part to advance equity for a just energy transition.

Build a value framework

Knowing what you value and being able to quantify the benefits of investments can help you make the best choices for the best outcomes. This is vitally important when it comes to equitable investment planning, because these value measures are useful metrics in communicating social impact.

When you look at where to invest your limited resources, you may ask: What if there are two different projects, with different timescales, and different costs and impacts?

The first step is to assess the value of each investment, such as:

- How does this investment reduce safety risk exposure?

- What is the emissions impact of this investment?

- How are different communities and population groups impacted?

While it might be easy to compare a handful of investments, what happens when you have thousands of projects in your portfolio, with dependencies and constraints that change based on how, when, and where you invest?

Here’s where a value framework can help. Any number of measures can be defined, including financial and non-financial benefits, risks, service measures, KPIs, and Environmental, Social, and Governance (ESG) factors. It can use attributes related to your assets (like age or manufacturer, number of customers they serve), as well as attributes related to environmental justice (customers being served in economically disadvantaged zones, environmental impact, or hazard exposure).

This allows even the most dissimilar projects to be compared on a common economic scale. Using a consistent, transparent, and value-based process to assess all investments and develop your plans will make it easier to demonstrate your rationale for choosing specific projects.

Consider current circumstances and future impact

When it comes to environmental justice as it relates to critical infrastructure, there are many factors that contribute to the livability of communities:

- Emissions exposure: carbon emissions and leaks from stations, or highways and traffic

- Asset risk exposure: leakage, reliability, and safety concerns due to older infrastructure and the impacts of climate events

- Cost increases: communities with lower incomes and homes that are less energy-efficient are paying more

Because of these factors, many regulatory bodies require consideration of environmental justice in investment plans. There are also initiatives like Justice40 in the US that have established goals to direct 40% of overall benefits of federal investments to disadvantaged communities.

Many current legislations are asking companies to demonstrate how they’re being fair with infrastructure investments and service delivery. So, unless you have a very clear breakdown of how and where you’re investing, these decisions can be hard to communicate and defend.

Use GIS tools to inform your decisions

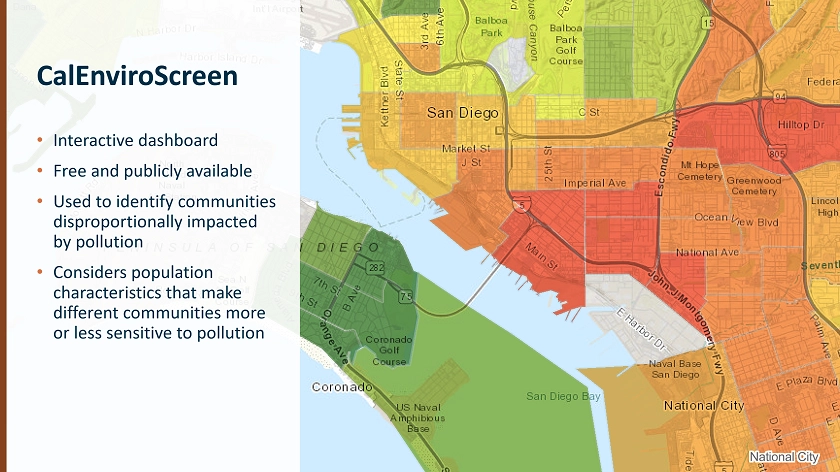

There are a lot of publicly available screening tools, such as CalEnviroScreen and EJScreen, that combine Geographic Information System (GIS) and census data to provide a view of the communities and areas disproportionately affected by environmental impacts like pollution, storms, wildfire, and floods. Certain geographies or population characteristics can make some areas more sensitive than others.

Figure 1: CalEnviroScreen uses GIS and census data to highlight communities disproportionately impacted by pollution in San Diego

It’s also important to consider both the value of your proposed investments and where the value is really going. While injecting funds into a specific area is typically seen as a positive on the surface, digging deeper may reveal that projects like expanding substations or underground cable installations will contribute more emissions and noise to the area, thereby negating the benefits a community would be able to reap from the investment.

Suboptimal decisions can also be made for the sake of spending in certain areas—even though the value is not as high as it could be, such as replacing an asset earlier than necessary. Negative impacts are even more pronounced if the investments in an area do not directly serve that population. For example, installing assets may require road closures, causing disruption and in some cases, increased emissions in disadvantaged communities, but the energy is delivered to more affluent areas. Projects like these have been denied by regulators for their lack of environmental justice, because some communities bear the burden without the benefits.

With GIS tools, you can visualize the impact of projects on geographic areas, to understand and communicate how your investment plans will deliver value to the communities you serve.

Meet targets through optimization

Once you’ve identified what you value through a value framework and have used GIS data to map out which areas are most impacted by different types and levels of investment, the next step is optimization. The goal of optimization is to evaluate the vast number of possibilities and identify the best combination of investments to pursue that will deliver the best outcomes, based on your constraints and targets.

For example, as a part of your corporate strategy, you may need to maintain minimum levels of service and reliability, or you may have targets related to safety risk, greenhouse gas (GHG) emissions, etc. All your strategic objectives and targets can be incorporated into a decision analytics solution like Copperleaf—to calculate and articulate the value of your investments, and see the impact of different funding levels, constraints, and timing to create the best possible plan.

Pair your data with technology solutions like GIS maps and decision analytics to clearly see and define what you value as well as the impact of your investments. That’s how you can best visualize, optimize, and demonstrate equitable investing and your understanding of your organization’s impact on people and the planet.

To learn more about this topic, watch the webinar recording and feel free to contact me with any questions or even just to share your experience and perspective.