Unlocking Offshore Wind Value in APAC: Meeting the Challenges Head-On

Offshore wind in Asia-Pacific is at a turning point. National targets are ambitious, capital is flowing, and projects are scaling up across the region. Yet, as developers, operators, and investors know all too well, success depends not just on building capacity — but on making the right decisions in a landscape of uncertainty, cost pressure, and rising expectations.

As the GWEC APAC Summit approaches, we’ve been listening to industry leaders across the region. Three themes stand out:

1. Capital Allocation Under Uncertainty

Multi-billion dollar CAPEX commitments must be made years before policy and permitting pathways are fully defined. In markets shaped by consortia, JVs, and state-utility partnerships, decision-making becomes even more complex: multiple stakeholders, competing priorities, and pressure from boards and regulators for transparency.

The challenge: How can leaders optimise scarce capital when timelines, costs, and revenues are constantly shifting?

Forward-thinking organisations are turning to structured, value-based decision frameworks that allow them to:

- Compare investments across ROI, risk, ESG, and timing

- Model multiple scenarios and re-optimise instantly as conditions change

- Provide auditable, defensible investment decisions that win stakeholder trust

2. Escalating O&M and Supply Chain Bottlenecks

As projects expand and turbines move into mid-life, the cost of operations and maintenance rises rapidly — especially once OEM service agreements expire. Across APAC, competition for vessels, ports, and specialist crews drives up costs and threatens availability.

The challenge: How can asset managers keep turbines spinning at peak output while controlling costs?

Leaders are applying risk-based asset management approaches that:

- Optimise maintenance schedules and extend asset life

- Bundle interventions intelligently to reduce vessel days and crew time

- Improve availability and reduce OPEX by targeting the right actions at the right time

3. Balancing Growth with ESG Commitments

Investors, regulators, and communities now expect more than megawatts. Every decision is scrutinised for its impact on net-zero pathways, biodiversity, and social outcomes. ESG is no longer an add-on — it must be embedded in capital allocation and asset strategies.

The challenge: How can organisations prove that every dollar invested advances not only profitability but also sustainability goals?

Industry leaders are embedding ESG metrics directly into investment and asset decisions, enabling them to:

- Demonstrate alignment with national decarbonisation roadmaps

- Build credibility with investors and regulators through transparent reporting

- Create resilient portfolios that deliver both financial and social value

The Value at Stake

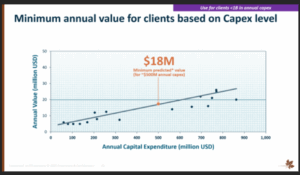

Analysis across asset-intensive sectors shows that even mid-scale operators (with ~$500M annual CAPEX) can unlock double-digit improvements in realised value. For offshore wind, that translates into tens of millions of dollars each year that can be reinvested into growth, resilience, and decarbonisation.

Why This Matters for GWEC Delegates

- For CXOs & Capital Planners: the priority is maximising value from scarce capital while meeting regulatory and investor expectations.

- For Asset Directors & Engineers: the focus is controlling O&M costs, extending asset life, and ensuring availability.

Both perspectives are essential, and both benefit from structured, value-based decision frameworks.

Let’s Continue the Conversation at GWEC APAC Summit

APAC Wind Energy Summit 2025

16 – 18 September – Melbourne, Australia

Join industry leaders and policymakers at the APAC Wind Energy Summit 2025 in Melbourne to tackle wind energy supply chain and market design challenges.

Website

I will be at the GWEC APAC Summit in Melbourne to engage with leaders on these challenges. If you are facing similar issues in your organisation, let’s meet to exchange perspectives and explore practical approaches to unlock more value from your assets and portfolios.

Brian Pye

Industry Director APAC

IFS Copperleaf