Middle-Out Investment Planning – The Best of Both Worlds (Part 1)

Investment planning approaches and challenges

Investment planning often involves tension between two approaches: top-down (holistic understanding of business objectives but may have vague KPIs) and bottom-up (detailed and tailored to team or asset needs but may be misaligned with business objectives).

However, a middle-out approach strikes a balance between both, enabling strategic alignment and operational deliverability, especially for asset-intensive organisations.

The top-down challenge

A top-down approach starts with analysing and reviewing organisational objectives, then developing potential investment options to help achieve those goals.

Several challenges can arise with this approach, including:

- Vague and unattainable KPIs. A set of investments that are intended to drive the organisation’s KPIs may be too vague to be achievable. For example, wanting to reduce carbon emissions by 50% by 2050 without a quantitative understanding of how this will be achieved.

- Investment plan isn’t achievable. The resulting investment plan may not be deliverable if it doesn’t consider the organisation’s capabilities and constraints, such as resource limitations in certain geographies or skills shortages in certain domains. For example, there may be too many projects in one geographic area but not enough people to execute the work.

- Misalignment with regional needs. Some business units may be ‘forgotten’ if investments aren’t strategically aligned, which can create additional, and often unforeseen, issues. For example, placing significant focus on ‘high-value’ investments in metropolitan areas but neglecting the needs of regional communities.

The bottom-up challenge

A bottom-up approach starts with identifying investments that are specifically geared towards addressing specific problems or opportunities related to the needs of individual business units and assets.

Several challenges can arise with this approach, including:

- Lack of alignment to organisational objectives. This approach may impact the organisation’s ability to achieve its strategic objectives, especially if there’s no quantitative way to assess how individual investments or projects will contribute value and support those goals. For example, many investments across the organisation may focus on environmental value, but there may not be enough projects that contribute to achieving social objectives.

- Inability to make trade-off decisions across the business. It can be difficult to optimise investments across different business units or geographies. This is often the result of allocating funding for each business unit without a consistent, transparent way to compare investments across them. For example, a low-value investment in one business unit may be selected over a high-value investment in another because the low-value investment may be a top priority within its own area; this may not result in the best use of funding for the organization as a whole.

- Investment decisions aren’t based on value creation. A bottom-up approach starts with ideating and prioritising projects in independent groups. However, since there are many ways a project can deliver benefits, it’s important that value be expressed on a common scale. For example, every business case should illustrate how the project contributes value and the extent of that value, so that an investment that delivers liability outcomes can be compared on equal footing with an investment that delivers increased revenue.

Where’s the value?

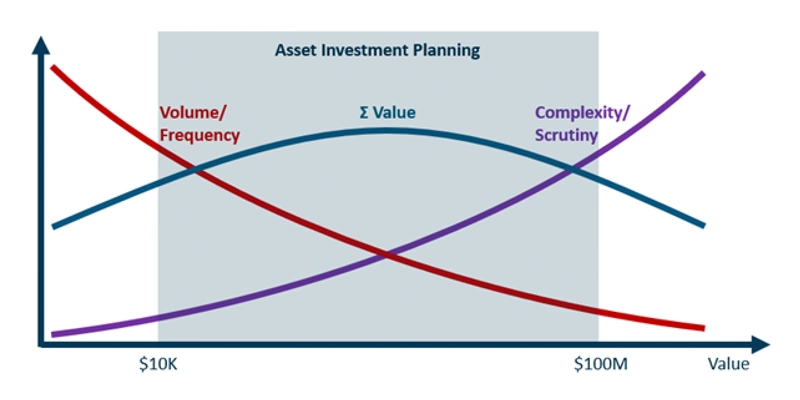

A middle-out approach can be useful for any investment portfolio, but it’s particularly beneficial for investments of a medium size and complexity level.

Small investments (such as annual maintenance, safety inspections, or mandatory tests) are best suited to a bottom-up approach because of their mandated and/or repetitive nature.

Strategically significant investments (such as a new line of business or project) are best suited to a top-down approach because of their strategically significant and bespoke nature.

The investments in between (see Figure 1 below) are ripe for a middle-out approach that achieves the best of both worlds. Although the size and complexity of this middle area (highlighted in blue) will differ for each organisation, it typically includes investments ranging from $10k to $100m.

The middle-out approach

The middle-out approach starts with creating a decision-making framework that uses quantitative measures to assess how investments deliver value. This starting point allows for alignment to the organisation’s strategic objectives and risk appetite—and a level of specificity that ensures relevance and achievability of the investments.

The middle-out approach involves these steps (summarised in Figure 2 below):

- Create a value framework

- Use the framework to assess all investments on a common economic scale

- Set constraints and targets to create an executable plan

- Optimise the investment portfolio to create the highest-value plan

In the next part of this blog series, I’ll dive deeper into how the middle-out approach can help create investment plans that are strategically aligned and operationally achievable.