Align every capital decision with your organization’s strategic goals.

IFS Copperleaf Integrated Planning is a comprehensive, enterprise-wide approach to capital and asset strategy, bridging long-term vision and short-term execution across all portfolios and lines of business.

Siloed plans, static cycles, and competing priorities make it difficult for executives to ensure that day-to-day investments support strategic outcomes. Integrated Planning solves this by creating clear line of sight between strategy and execution across all areas of the business, now and into the future.

With this new approach to capital and asset strategy, leaders can prioritize the right work at the right time, optimize limited capital, and dynamically adapt to change—driving capital efficiency, managing risk, and advancing ESG and financial objectives.

Execute your strategy, no matter the time horizon

When long-term strategy and short-term operations aren’t aligned, organizations waste capital, miss targets, and lose stakeholder confidence. Ensure every investment decision—whether it’s for next year’s budget or a 10-year modernization initiative—directly supports enterprise objectives. Connecting these time horizons ensures every investment supports strategic goals.

Integrated planning aligns strategic, tactical, and operational plans through a single decision-making framework, giving leadership a clear roadmap from vision to execution.

Allocate capital with confidence

Utilities and infrastructure-intensive organizations constantly juggle competing priorities across business units and timeframes. Without a clear framework, resource allocation becomes reactive and inefficient.

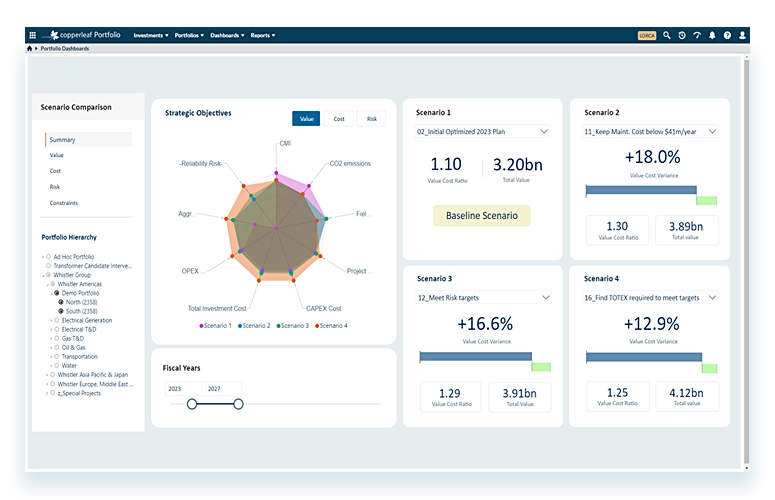

IFS Copperleaf uses advanced optimization to allocate resources to the highest-value initiatives, maximizing return while balancing constraints across your portfolio. Prioritize and allocate capital across business units, geographies, and timeframes based on what delivers the most value. IFS Copperleaf’s optimization engine considers all constraints and objectives—operational, financial, ESG—to help you do more with less and unlock hidden value across your portfolio.

Keep your plans agile

In a world of constant change—from regulatory shifts to extreme weather events—static plans fall short. Traditional annual planning cycles can’t keep pace with shifting regulations, emergent risks, or budget fluctuations, leading to misaligned priorities and missed opportunities.

With IFS Copperleaf, organizations adopt a continuous planning model that enables rapid reforecasting and dynamic decision-making whenever the landscape changes, so you can respond swiftly and maintain alignment without waiting for the next planning cycle.

Put what-if scenarios to the test

Making the wrong bet on future conditions, like electrification rates or asset performance, can derail budgets and undermine reliability. IFS Copperleaf enables what-if scenario analysis so you can model uncertainty, quantify risk, and choose resilient investment paths that deliver the most value under any future state.

Get your goals out of siloes

Organizations face increasing pressure to demonstrate how investments contribute to sustainability and compliance, but many struggle to connect planning with these outcomes. Copperleaf quantifies ESG impact and regulatory alignment on the same economic scale as cost and risk, empowering you to make and defend sustainable, stakeholder-aligned decisions.