Middle-Out Investment Planning – The Best of Both Worlds (Part 2)

A Deep Dive on the Middle-Out Approach to Investment Planning

Part 1 of our blog on middle-out investment planning explored the challenges of the top-down and bottom-up approaches. Using a middle-out approach can overcome these challenges and achieve the best of both worlds—especially for investments ranging from $10K to $100M. In this second part, I’ll dive deeper into the four steps and highlight best practices in each area.

1. Create a value framework

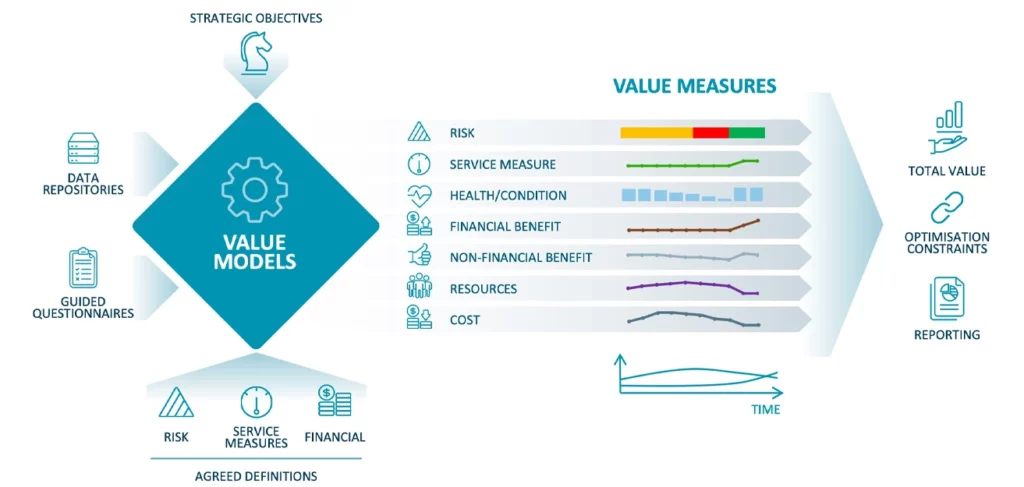

First, create a quantitative decision-making framework to ensure you’re allocating limited budgets and resources towards the most valuable areas of your business. This framework should be based on your high-level strategic objectives and use metrics (value measures) to assess how different investments contribute to these goals. This ensures individual investments—and the collective investment plan—are aligned with these objectives.

The Copperleaf® Value Framework connects strategic drivers to investments using quantitative value measures. With this framework in place, your organisation can evaluate risks, benefits, service measures, costs, KPIs, and Environmental, Social, and Governance (ESG) factors in common economic terms and on equal footing. This allows trade-off decisions to be made across your entire company.

Figure 1. Copperleaf Value Framework structure

2. Use the framework to assess all investments on a common economic scale

Next, develop a set of investment candidates and use the framework to evaluate all proposed projects. Having a central repository for everyone in the organisation to put forward their investment requests can reduce the pain of working with multiple, disconnected spreadsheets across departments. It provides “one source of truth” for all planning data, allowing stakeholders to collaborate and provide input on projects as they evolve from idea to execution.

Here are some best practices that can help improve planning efficiency and drive better business outcomes:

- Project proposals should include a complete and quantitative business case that shows how projects will contribute value to your organisation.

- Exploring different options or alternatives (e.g., maintaining an asset vs. refurbishing or replacing) is important, to ensure due diligence and planning flexibility, in case there’s not enough money or resources to pursue all projects.

- Using a shared set of cost models across your organisation allows planners to create more accurate and consistent estimates for capital costs, operating and maintenance (O&M) costs, and resource requirements, resulting in more standardised and defensible business cases.

- Workflows can be configured to automate existing business processes and move investments through stage gate reviews, ensuring the right people approve investments before they’re included in your plan, leading to quicker turnarounds, as well as greater transparency and auditability.

3. Set constraints and targets to create an executable plan

As discussed in the previous article, an investment plan may not be achievable if it doesn’t consider your organisation’s constraints, such as resources (human and material), timing, project dependencies, and more. It should also incorporate targets related to risk, KPIs, and Level of Service (LOS) goals. Examples might include targets related to safety incidents, greenhouse gas (GHG) emissions, grid performance, downtime, etc.

The reality is that organisations must meet all constraints and targets simultaneously; only meeting one at a time isn’t very useful in a plan because in the real world, we are subject to all of them at the same time!

To create a plan that is both strategic and executable, it must balance your desired business outcomes with your organisation’s limitations. This is where optimisation plays a crucial role.

4. Optimise the investment portfolio to create the highest-value plan

Optimisation allows planners select the best combination of investments and timing that will deliver the most value and drive your strategic objectives, while respecting all constraints and targets. Best-in-class optimisation uses Artificial Intelligence (AI) to quickly find an optimal solution that would otherwise be impossible or impractical to determine using traditional methods.

It considers all the following factors:

- Value. Optimising an investment plan must be based on total value, which includes the cost of the investments and benefits across all value measures. An independent research study concluded that optimisation delivers up to 20% higher portfolio value for the same spend compared to prioritisation.

- Time. Every element of a project justification changes with time. Costs, benefits, resource availability, etc., all change when a project is deferred or advanced. Project justifications should therefore be time dynamic, so that the business case automatically adjusts if the timing shifts. An optimised plan details the best combination of investments to pursue and the best time to execute each project.

- Asset-informed. Many projects are related to the replacement or refurbishment of existing assets, and their justifications are largely driven by avoiding the risk of asset failures. If the timing of a project changes, the risk may become unacceptable, which impacts how you must consider and justify the investment.

- Resource and cost constraints. It’s crucial to include constraints in the optimisation process to ensure the deliverability of your plan.

- Strategic goals and risk targets. In addition to constraints, it’s equally important to optimise the plan to meet risk, KPI, level of service, and other targets to ensure your investment plan achieves your strategic objectives and stays within your organisation’s risk tolerance. This is where you’ll realise the benefits of linking quantitative measures to your objectives through a value framework.

- Scenarios. The future is uncertain. What-if analysis plays an important role in testing the robustness of your plan under a variety of potential future scenarios. Exploring different scenarios can help your company compare investment strategies and gain agreement on the best path forward.

The Copperleaf Decision Analytics Solution supports all these principles. It uses AI-powered optimisation to analyse large portfolios with many different projects and alternatives, while factoring in asset dependencies. It can help your organisation identify the highest-value plan within minutes—and re-optimise the plan to adapt quickly when business conditions change.

In summary, a middle-out approach results in an investment plan that is strategically aligned and operationally achievable.

To learn more about how to implement a middle-out approach to investment planning, reach out to me directly or download our “Driving Strategy Through Value-based Decisions” white paper.