As passenger volumes return to pre-pandemic levels, airports face mounting pressure to expand capacity, enhance the passenger experience, and meet sustainability goals – all while dealing with budget constraints and a backlog of deferred maintenance.

Copperleaf’s AI-powered decision analytics solution helps airports make the right investment trade-offs to:

- Increase portfolio value by 4% or more through optimized capital allocation

- Align investments with strategic KPIs and business drivers

- Automate and streamline capital planning processes, boosting efficiency by 50%

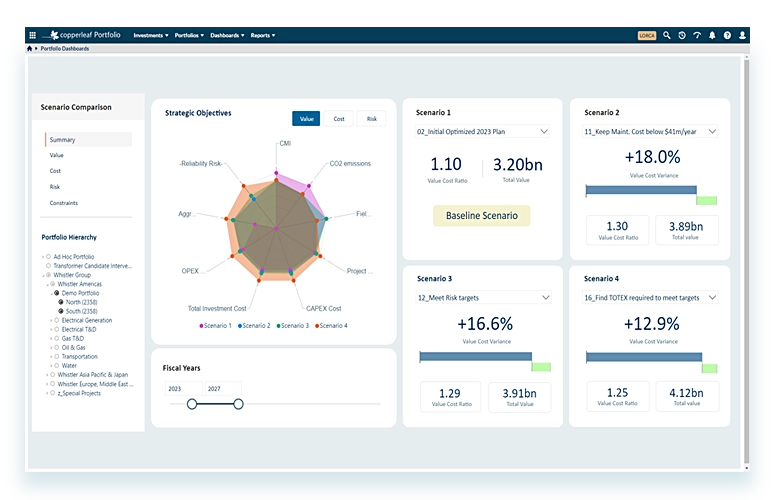

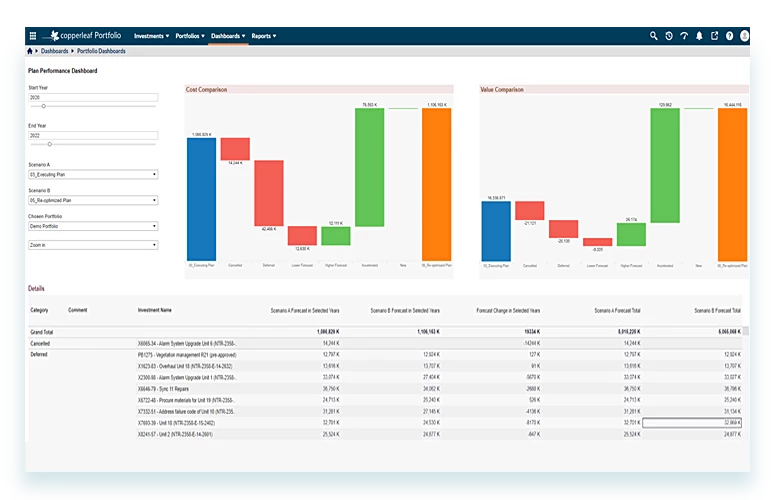

- Run multiple scenarios to understand the impact of different decisions

- Gain transparency across your entire capital portfolio

Our airport clients have recovered their investment within the first planning cycle by:

- Identifying 20% more value in their investment plans

- Removing 2-6% of negative value investments

- Reducing plan creation time by 50%

- Improving plan execution by 10%

Receive the most benefit from your spend

Achieving the highest value from your plans means carrying out the right investments at the right time. This is no easy task for organizations with hundreds of candidate investments across business lines.

Copperleaf’s AI-powered optimization evaluates the vast number of possibilities and identifies the highest-value investment plan within minutes. Create any number of what-if scenarios to compare, contrast, and communicate the impact of each approach on cost, risk, value, and other strategic targets.

Spend less time planning and more time doing

Planning teams continue to be challenged by the sheer scale of their planning process. Significant time is regularly required to source, analyse, and manage data across the organization.

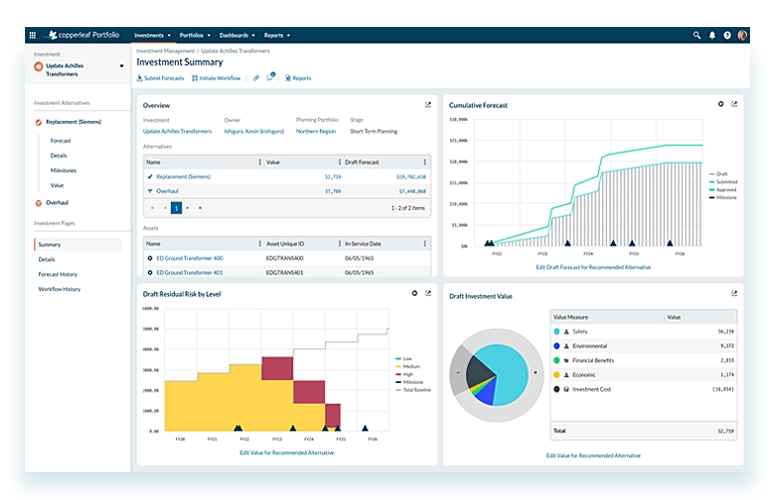

Copperleaf Portfolio saves you time by streamlining the process of developing, approving, and managing investments through their full lifecycle. It provides a centralized, enterprise-wide platform to easily capture all investment candidates, allowing them to be consistently scoped, costed, valued, and organized efficiently into portfolios. Planning teams can be confident that their decisions are based on complete and current information from across the organization.

Manage your risk exposure

Without a comprehensive and quantitative risk assessment, you cannot be sure of your organization’s resilience in the face of changing external factors, from cybersecurity breaches to extreme weather events.

Copperleaf Portfolio enables organizations to develop comprehensive plans that ensure ongoing performance and reliability. Any number of risk types can be specified and modeled making it easy to understand your overall risk exposure and how it will evolve over time.

Drive your strategy

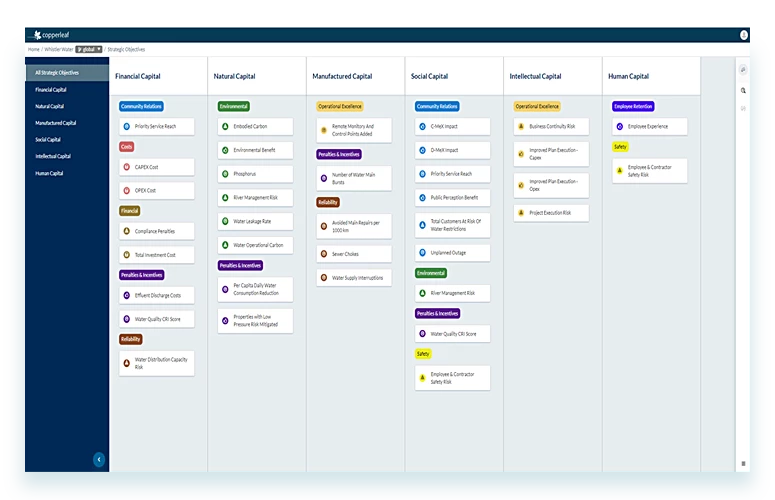

To make progress on your strategic goals, you need a way to measure progress and compare approaches. Copperleaf Portfolio leverages the Copperleaf Value Framework to consistently assess the value of every investment and align decisions to the strategic priorities of your organization.

Portfolio quantifies how each investment contributes to the achievement of the organization’s strategic goals. Every investment can be compared based on its total value (including contributions to strategic objectives) so that difficult trade-offs can be made with confidence.

Blog

First Airport Roundtable ‘Flight Path to Success’: Capital Planning Transformation at Vancouver International Airport

Virtual

Future Focus: Strategic Capital Planning & Asset Management in Transportation

May 8, 2025 | Online, 9:00 - 10:00am PDT

Blog